Investor Resources

Access a range of investor resources to help you assess, understand, and apply for the Australian Securities Term Fund, Income Fund and Property Fund.

Australian Securities Overview Videos

Product Disclosure Statements (PDS) with Application Forms

Each PDS has the application form attached or, if preferable, a simpler online investment application can be completed under the Apply page, to start the application process.

Product Disclosure Statements

Target Market Determinations (TMD)

The TMD sets out the class of consumers for whom the investment product, including its key attributes, would likely be consistent with their likely objectives, financial situation and needs. Each TMD should be read in conjunction with its relevant Product Disclosure Statement.

Annual Reports

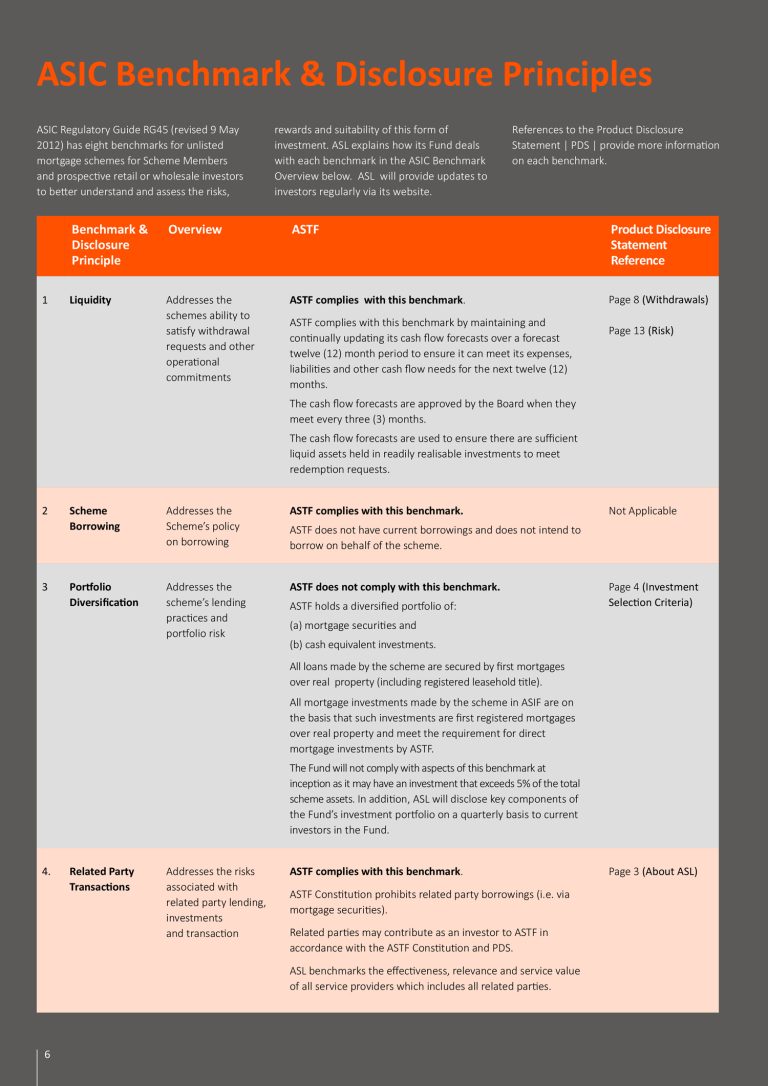

ASIC Benchmarks

The benchmarks will help you better understand and assess the risks, rewards and suitability of the Funds available for investment. Benchmarks should be read in conjunction with relevant Product Disclosure Statement from each Fund.

Investment Complaints

Download processes that are in place for handling investment complaints.

Your questions answered

Are any resources provided by the Fund manager to assist in making informed choices.

Yes. Members are provided with detailed summaries, reports, valuations, and historical performance statistics to help them make informed choices on Fund investment. Ensure you read this material in conjunction with the Product Disclosure Statement and the Target Market Determination for the relevant Fund.

What is a Mortgage Investment Summary (MIS) in the Income Fund?

The (MIS) is a Booklet containing a summary of the mortgage terms and a copy of the valuation, copy title, copy mortgage, and copy Trust Declaration (for Nominee Mortgages) detailing the approved investment.

What is a Mortgage Security Description (MSD)?

The MSD is a Form provided to a Member summarising a mortgage security for investment in a sub-scheme for approval by the Member and contains information on the Member’s contribution, which is not allocated to the Sub-scheme until the investor signs and returns the MSD authority approving the mortgage security.

What is a Property Description Certificate (PDC) in the Property Fund?

After the Fund Manager has completed their due diligence, A Property Description Certificate (PDC) is issued as Part 2 of the PDS (Supplementary PDS) to Members to identify the Sub-scheme property and its attributes for approval by the Member. The Member signs and returns the PDC authority approving the mortgage security.

Why do I need ASIC Benchmarks?

ASIC has developed benchmarks for unlisted mortgage schemes and property schemes to help Scheme Members and prospective retail or wholesale investors to better understand and assess the risks, rewards and suitability of this form of investment. Specific benchmarks are available for each Fund.

What is a Target Market Determination (TMD)?

The TMD sets out the class of consumers for whom the product, including its key attributes, would likely align with their potential objectives, financial situation and needs. In addition, the TMD outlines the triggers to review the target market and certain other information. It forms part of Australian Securities Limited’s design and distribution arrangements for the product. A Target Market Determination is available for each Fund.

Does Australian Securities provide an investment platform?

Members have access to a dedicated wealth management platform with performance analysis and monitoring. Members can

- Withdraw, invest, and view new investment opportunities from this platform for each Fund

- Monitor individual client portfolio performance with analytics that cross-references an entire Funds returns

- Access each portfolio’s inventory of investments, past and present, including individual investment Terms, repayment dates and investment amounts contributed to each Sub-scheme

- Access detailed tax statements for each Fund at the click of a button.