The economic year in review shows us that volatility in the investment market might remain for some time yet. Despite 13 rate rises since May 2022, the expected housing market crash did not eventuate and neither has the “fixed-rate cliff”. Consumer spending is not entirely to blame for the stubborn inflation rate and government spending is being partially blamed. Geopolitical issues are increasingly causing global economic concerns that are impacting financial market confidence. In short, during a volatile time and economic uncertainty, knowing where your money is and that it’s safe is crucial.

Inflation

Despite 13 interest rate hikes since May 2022, Australia grapples with persistently high inflation, reaching 5.60% as of September 2023. This surge is primarily attributed to escalating fuel costs and domestic expenses related to housing, electricity, food, and wages. Economists are particularly concerned about the resilience of services inflation, with notable increases in sectors such as veterinary and pet services, restaurant meals, hairdressers, financial services, and insurance.

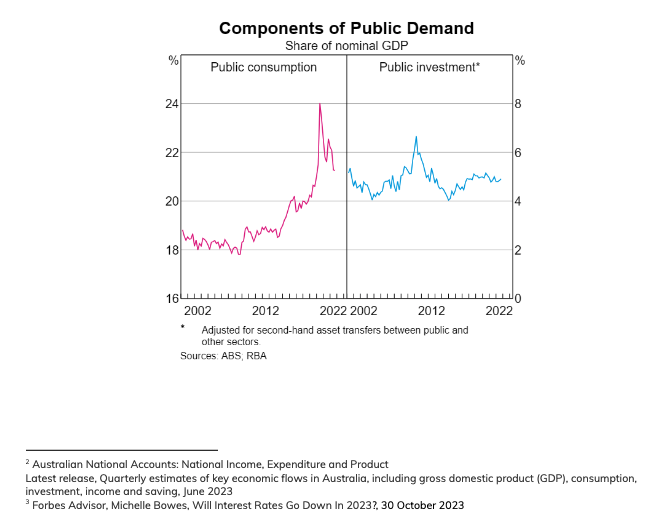

Ongoing federal, state and local consumption and infrastructure spending are still sitting above pre-pandemic levels, taking much-needed labour from the private sector and putting pressure on inflation. Expenditure was pushed up by ongoing support for those affected by natural disasters and programs like the National Disability Insurance Scheme. Despite a strong pipeline of infrastructure projects, labour and materials shortages pose challenges to the pace of completion.

In the last quarter, “total public investment increased 8.2% in the June quarter. While growth was boosted by second-hand asset transfers from the private sector, new investment was also strong at 5.5%. This reflected ongoing work on large-scale transport, health and education projects across several states.”

Several other factors are working against inflation, including a 5.75% pay increase for 2.4 million workers granted by the Fair Work Commission, the entry of 500,000 migrants impacting housing and employment markets, and sustained high levels of federal, state, and local consumption and infrastructure spending. Russia’s invasion of Ukraine, which has affected the production of many goods and supply chains due to constrained oil and gas supplies, has negatively impacted inflation.

Cash Rate Movements

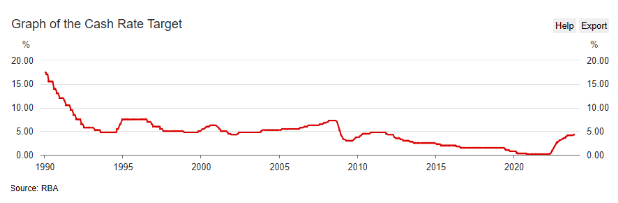

In 2023, the Reserve Bank of Australia (RBA) persistently raised the cash rate to rein in inflation—the most recent uptick in November, totalling 0.25%, further strains mortgage holders and household expenditure.

Looking ahead to 2024, the RBA plans to streamline its operations by reducing the frequency of meetings from 11 to 8, aligning with international practices such as the United States’ Federal Reserve Open Market Committee (FOMC). This adjustment reflects a more efficient approach and allows the board additional time for a thorough examination of economic indicators and the ramifications of cash rate decisions. Understanding the strategic shifts within the RBA is crucial for sophisticated investors in navigating the evolving financial landscape.

Migration

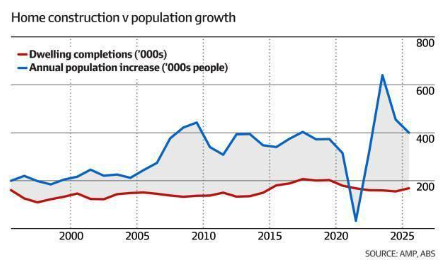

Australia’s population surged by 2.2% to reach 26.5 million people in the year ending March 2023, with net overseas migration accounting for 81% of this growth, adding 454,400 individuals. This increase is primarily attributed to a significant rise in arrivals, up 103% to 681,000, and a modest increase in overseas migrant departures, up 8.8% to 226,600. The low departure rates are considered a catch-up effect following closed international borders during the pandemic, with a temporary expectation for increased departures as international students return to their home countries.

Estimates from the federal budget indicate that Australia’s migrant intake in the year to June was approximately 400,000, more than double the pre-COVID-19 average.”. The return of international students has contributed to this surge, prompting concerns from AMP chief economist Shane Oliver. He suggests that to prevent overwhelming government efforts to boost housing supply and affordability, Australia should reduce its annual immigration intake to 200,000—less than half of the current 500,000. The heightened concentration of net overseas migration is exerting demand-side pressures on housing costs in the short term, particularly in certain rental markets, contributing to an acute housing shortage and diminished affordability.

Geopolitical Issues

Global geopolitical shifts are reshaping the world, impacting Australia significantly. The Russia-Ukraine conflict heightens capital flows, trade, and commodities risks, causing supply chain disruptions and inflationary pressures. Tensions between China and Australia, marked by tariffs and political disruptions, emphasise the need for resilience and reduced reliance on the Chinese market. The Israel-Hamas conflict raises concerns about oil prices, affecting global economic perceptions and potentially contributing to financial volatility and inflation fears. Investors are bracing for increased uncertainty across various markets.

Commercial Property Prices

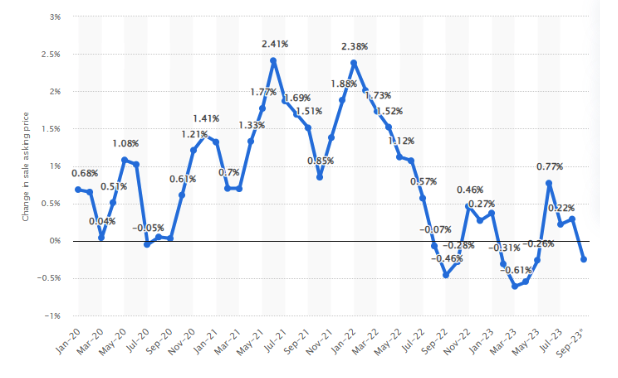

Commercial property sales are slowly rising, but challenges persist in bridging the gap between landlords and buyers, influenced by factors like interest rate hikes, remote work trends, and global uncertainties. JLL’s Q3 2023 preliminary figures show a notable 106% increase in office volumes from Q2, reaching $1.2 billion in the September quarter, with significant deals, including divesting industrial assets to UniSuper.

Offshore investment, primarily from Hong Kong, the USA, and Singapore, constitutes 19.0% of total investment volumes, underscoring Australia’s ongoing appeal for global capital due to its growing population and economic resilience. However, the NAB Commercial Property Index reflects negative sentiment, especially in the office and retail markets. The Industrial sector stands out with improved sentiment and expectations for capital growth in the coming years.

Office vacancy rates reached 10.2% in Q3, with a modest expected dip next year, and funding conditions, while challenging, are anticipated to improve in the next 3-6 months. Property developers’ plans for new works are below average, signalling subdued construction activity. Overall, the commercial property market faces challenges, with offshore investment and economic trends shaping the landscape.

Include graph: Monthly change in commercial property sale asking prices in Australia from January 2020 to September 2023 https://www.statista.com/statistics/1362593/australia-monthly-commercial-property-sale-asking-price-change/

Residential Property Prices

The resilience of the residential property market has defied expectations in 2023, surprising economists. Following a slight dip at the beginning of the year, prices stabilised and exhibited a 7.6% national increase year to date. Projections from KPMG’s latest property report suggest further growth, with residential house prices expected to rise by 3-5% in 2024 and experience a notable surge of 9.4% in the year leading to June 2025.

This upward trajectory is attributed to a combination of factors, including an undersupply of housing, population growth fueled by the return of migrants and overseas students, and a sustained demand that persists despite November’s interest rate hike. Dr Brendan Rynne, KPMG Chief Economist, emphasises the supply issue alongside several factors propelling asset prices higher, such as increased demand from migration, anticipated rate cuts in FY25, potentially relaxed lending conditions, rising rental costs pushing renters towards buying, barriers for developers in constructing new homes, a resurgence in foreign investor demand, and the enduring post-pandemic trend for more spacious living due to continued remote work.

Fixed Interest Rate Cliff

Contrary to expectations, the anticipated “fixed interest rate cliff” projected to impact housing prices has not materialised. Although a significant number of mortgagees are still transitioning from fixed to variable interest rates, concerns about a surge in distress sales have yet to manifest. NAB Chief Economist Alan Oster notes that individuals facing financial stress due to rising interest rates are adapting by taking on second jobs or cutting back on expenditures.

While there is still apprehension about the looming “fixed rate cliff,” RBA data indicates that most mortgage debt is currently on variable terms. KPMG Chief Economist Dr Brendan Rynne highlights that first-time buyers now allocate around half of their earnings to mortgage payments, a substantial increase from a third just three years ago. An estimated $350 billion of mortgages covering 880,000 Australian households are set to expire this year, with an additional 38 per cent, including about 450,000 loan facilities, expiring in 2024 and beyond. Despite these projections, distressed sales have yet to see a significant increase. Recent figures from Domain reveal a decline in distressed listings across capital cities, with Sydney, Melbourne, Hobart, Darwin, and Perth all experiencing reductions in distressed percentages compared to the previous year.

Government big spending on Infrastructure Projects

The International Monetary Fund (IMF) has attributed part of the responsibility for the increasing inflation to the Federal Government, suggesting that the elevated levels of infrastructure and consumption spending are better suited for revitalising a sluggish economy. The abundance of infrastructure projects is also noted to contribute to the ongoing labour shortage, as government initiatives vie with private projects for the available workforce.

A recently released independent review has found that the $120 billion infrastructure pipeline was facing $33 billion in cost blowouts. In response, Catherine King, Minister for Infrastructure, has announced that it will slash 50 projects with savings of $7 billion. Whether this measure will effectively alleviate inflationary pressures remains uncertain.

Minimum wage increase by 5.75%

On 1 July 2023, the National Minimum Wage and minimum Award wages increased by 5.75%. The new National Minimum Wage is $23.23 per hour, or $882.80 per week. The wage increase was dubbed the “biggest in history”, helping 2.7 million workers. While good for individuals, the wage increase was hard on the retail and hospitality industry, which has been impacted by rising inflation and the cost of living as people started to spend less to survive.

Scams

While specific figures for the total scams in 2023 are not yet available, it’s evident that scams are rising and becoming more sophisticated. In the first half of the year, scams increased by 50% yearly, as reported by the Australian Competition and Consumer Commission’s (ACCC) Scamwatch. Surprisingly, despite the surge in scams, financial losses experienced a slight decrease, with $293 million recorded in H1 2022 compared to $286 million in H1 2023.

Investment scams emerged as the most financially damaging during this period, accounting for 60% of all losses, surpassing $171 million. This is notable given that there were only 4,666 reports, nearly half resulting in financial loss. Not far behind are dating and romance scams, false billing scams, and phishing, costing Australians over $18.4 million, $17.4 million, and $17.3 million respectively in 2023.

In response to the escalating threat, ASIC’s new website takedown service provider has successfully removed numerous investment scams and phishing websites since July 2023. This targeted approach aims to identify and eliminate fraudulent and malicious websites reported by ASIC, contributing to a positive trend in reduced financial losses to investment scams. Assistant Treasurer and Minister for Financial Services, Stephen Jones, emphasised the effectiveness of anti-scam initiatives, noting a decline in losses to investment scams over the last quarter. Despite these positive signs, he emphasised the importance of ongoing vigilance to combat evolving scams.

Cyber Security

According to a government report, state-sponsored cyber groups and hackers are escalating their attacks on critical infrastructure, businesses, and homes in Australia. The newly formed defence agreement with Britain and the U.S. has heightened the country’s appeal as a target. The Australian Cyber Security Centre’s annual threat report reveals a 23% surge in cybercrime reports, surpassing 94,000 in the financial year up to June. It estimates a cyber intrusion on Australian assets occurs every six minutes, leading to the establishment of an agency in February to coordinate responses to these incidents.

In response to the rising cyber threats, the government is overhauling federal cyber laws, with details expected to be released next week. It is considering mandatory reporting of ransomware incidents by companies. The report indicates a 14% increase in the average cost of cybercrime to victims. A recent cyber incident at DP World Australia, a major ports operator, resulted in a three-day operational suspension. The average cost of cybercrime per report has risen, with small businesses facing $46,000, medium businesses $97,200, and large businesses $71,600.

Nigel Phair, a cybersecurity professor at Monash University, warns that cyber attacks against Australia will persist unless organisations prioritise security and robust risk management for their information assets.

Play it safe with Australian Securities

In a time of economic unrest and market volatility, choosing an investment opportunity that comes with transparency, certainty and security is imperative. Australian Security’s three funds, the Income Fund, Property Fund and Term Fund, all have conservative Loan to Valuation Ratios and securitised options to ensure your investment will safely grow, even in a volatile market.

Still not sure…

Call us on 1300 275 275 to talk to one of our Investment Managers or Investment Executives. We prioritise direct communication and personalised support for our clients.

If you liked this article, please share.